May 22, 2020

US Senate bill could delist Chinese companies from US stock exchanges

[ by Legal Era News Network ]

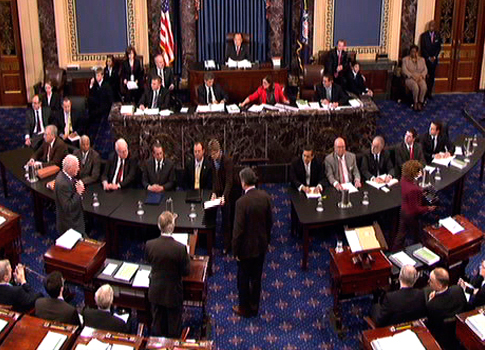

The United States (US) Senate has passed a legislation on May 21 that could ban Chinese companies from listing shares on American exchanges.

The legislation may also ban Chinese companies from raising funds from American investors.

The bill, moved by Louisiana Republican Senator John Kennedy would require companies to certify that “they are not owned or controlled by a foreign government”. They would be also be required to undergo an audit that could be reviewed by the Public Company Accounting Oversight Board, the non-profit body that oversees audits of all U.S. companies seeking to raise money in public markets.

Although the law can be applied to any foreign company, lawmakers have said that the move to strengthen disclosure requirements was aimed at China.

“The Chinese Communist Party cheats, and the Holding Foreign Companies Accountable Act would stop them from cheating on US stock exchanges,” Kennedy, a member of the Senate Banking Committee, said on Twitter.

“We can’t let foreign threats to Americans’ retirement funds take root in our exchanges.”

The passing of the bill is a reflection of the growing anger among US lawmakers towards China and its handling of the coronavirus pandemic. The Trump administration has also voiced support for stricter supervision of Chinese companies. The United States, henceforth, would be pushing for more accountability from Chinese companies listed in U.S. markets.

The White House last week directed the federal retirement savings body to halt investments in Chinese companies which is seen as the beginning of a financial war in addition to the trade war already on between the two countries.

Labor Secretary Eugene Scalia had warned that plans to invest federal savings would place “billions of dollars in retirement savings in risky companies that pose a threat to US national security”.

Before becoming a law, the bill would also need to pass the Democratic-controlled House of Representatives. Shares of Chinese e-commerce giant Alibaba saw its US-listed shares fall more than 2% on the development.

Read More