Kotak Mahindra Bank… launched qualified institutional placement (QIP) offering to raise up to ₹7,500 crore. The bank has set a floor price of ₹1,147.75 per share for the offering. QIP is a tool used by listed companies to sell shares or other securities to qualified institutional buyers such as mutual funds.

— Mint

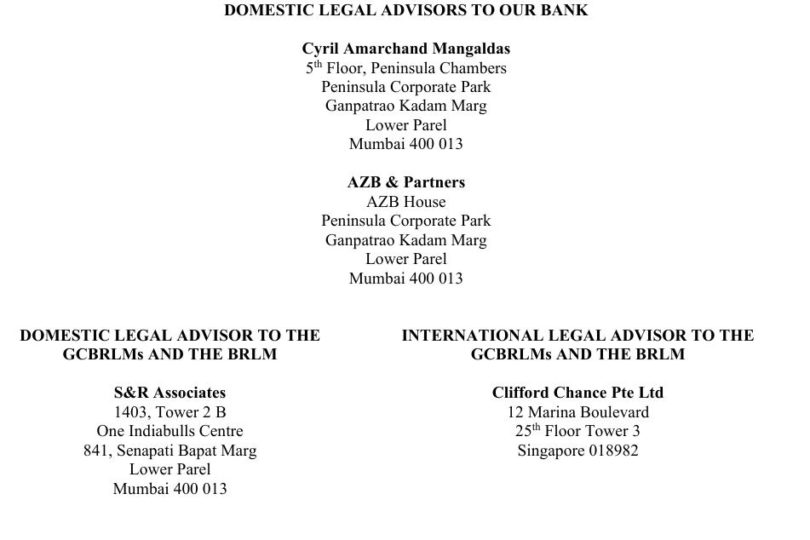

S&R Associates advised the

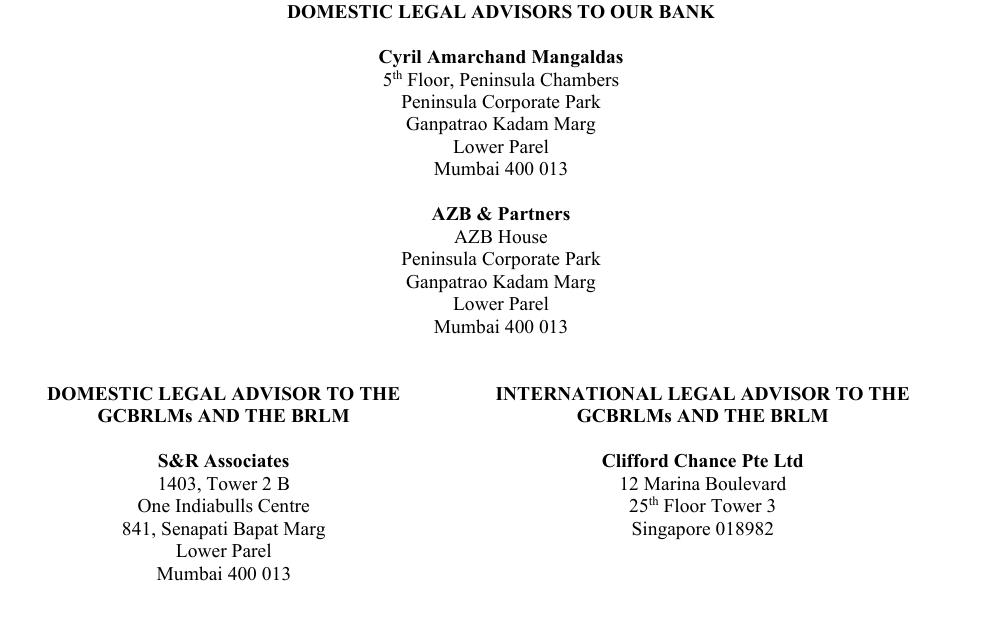

Somewhat unusually, the Mumbai offices of Cyril Amarchand Mangaldas and AZB & Partners both jointly acted for the issuer,

Clifford Chance acted as international counsel to the

This is the first QIP draft prospectus filed since the Avenue Supermarts Ltd issue filed in February 2020, on which Cyril Amarchand Mangaldas and IndusLaw had advised with Herbert Smith Freehills.

2020-05-26

Deal value: INR 74.43 billion

This deal report is based on a firm’s press release and may be only partially complete. Some firms or names of advisers may be therefore be missing.

Click here if you are working with a law firm that has not been credited for this deal, and we will update the report promptly.